FDA Medical Device Databases: Complete Search Guide 2025

- Beng Ee Lim

- Jul 24, 2025

- 11 min read

Updated: Oct 17, 2025

FDA maintains 15+ medical device databases containing approval data, adverse events, manufacturer information, and regulatory guidance. The most critical are the 510(k) database for predicate devices, PMA database for Class III research, Product Classification for device codes, and MAUDE for safety intelligence. Smart companies use these databases for competitive intelligence, faster regulatory submissions, and market analysis.

Most regulatory professionals waste hours manually searching FDA databases when strategic approaches could deliver better competitive intelligence in minutes. This comprehensive guide shows you exactly how to extract maximum value from each database to accelerate your regulatory strategy and gain competitive advantages.

Why FDA Databases Are Strategic Weapons

FDA databases aren't just regulatory archives—they're treasure troves of competitive intelligence, predicate data, and submission benchmarks that can help you streamline premarket submissions and understand market dynamics.

Strategic Value:

Predicate Device Intelligence - Find substantially equivalent devices for 510(k) submissions

Competitive Analysis - Track competitor approvals, claims, and safety issues

Market Timing - Identify approval patterns and regulatory trends

Risk Assessment - Understand adverse events and recall patterns

Regulatory Strategy - Learn from successful submission approaches

The Problem: FDA search engines don't allow specific search queries, hampering accessibility. Most companies waste hours manually searching when strategic approaches could deliver better results in minutes.

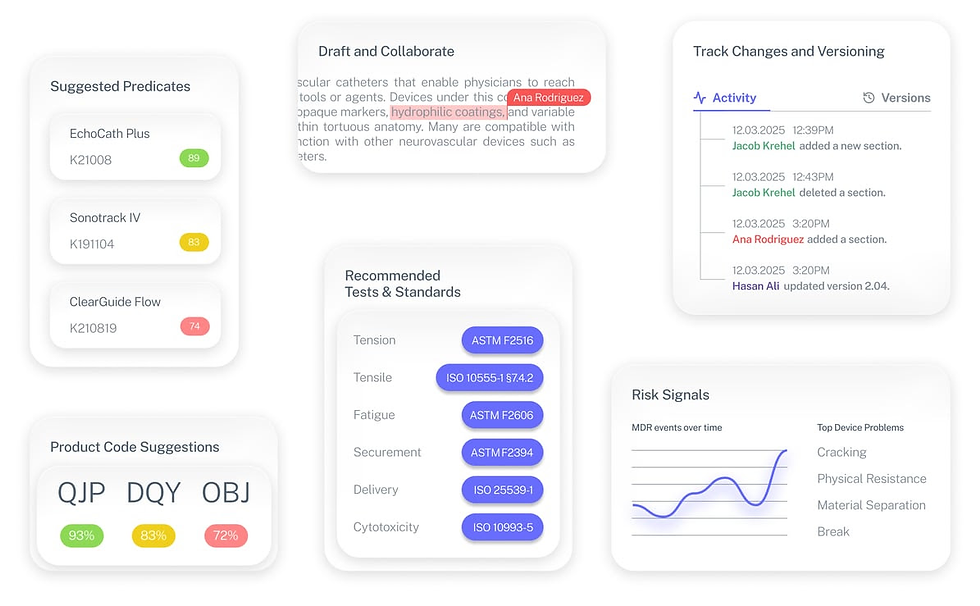

💡 The faster way to leverage FDA databases

Instead of manually searching across 15+ FDA databases, Complizen connects them for you - instantly mapping product codes, predicates, recalls, and recognized standards.

It’s how modern regulatory teams turn hours of research into actionable strategy in minutes.

Pre-Market Intelligence Databases

510(k) Pre-Market Notification Database

Purpose: Find predicate devices for substantial equivalence claims

What's Inside:

All released 510(k) submissions since 1976

Device names, product codes, summaries, and decisions

Predicate device chains and substantial equivalence arguments

Approval timelines and FDA review patterns

Strategic Search Techniques:

By Product Code: Start with your device's 3-letter FDA product code for targeted results

Search tip: Use partial codes (e.g., "MR" for cardiovascular) to broaden results

Cross-reference with Product Classification database for complete code lists

By Device Name: Use broad terms first, then narrow

Example: Search "glucose monitor" before "continuous glucose monitor"

Include synonyms and technical variations

By Date Range: Analyze approval patterns

Recent approvals (last 2 years) show current FDA expectations

Historical data reveals regulatory evolution and precedent

Competitive Intelligence Applications:

Track Competitor Activity: Set up regular searches for competitor company names

Identify Market Gaps: Find product codes with few recent approvals

Benchmark Claims: Compare your intended claims with successful submissions

Timing Analysis: Understand seasonal approval patterns and FDA review times

Access: FDA 510(k) Database

PMA Pre-Market Approval Database

Purpose: Research Class III device approvals and high-risk regulatory pathways

What's Inside:

All PMA approvals and supplements since 1976

Clinical trial requirements and study designs

Post-approval study commitments

Approval conditions and labeling restrictions

Key Search Strategies:

By Therapeutic Area: Focus on specific medical specialties

Search tip: Use broad anatomical terms (e.g., "cardiac," "orthopedic")

Review approval letters for clinical trial design insights

By Company: Analyze competitor PMA strategies

Identify companies with multiple PMA approvals in your space

Study their clinical development approaches and timelines

Clinical Intelligence Extraction:

Study Design Precedents: Understand FDA expectations for clinical trials

Endpoint Selection: See what primary endpoints FDA accepted

Patient Population: Learn about inclusion/exclusion criteria

Post-Market Commitments: Understand ongoing study requirements

Access: FDA PMA Database

Product Classification Database

Purpose: Understand device classifications, product codes, and regulatory pathways

What's Inside:

All medical devices with 3-letter product codes

Risk classifications (Class I, II, III)

Regulatory controls and special controls

FDA review organizations

Essential Search Methods:

By Device Type: Find your exact classification

Search multiple device name variations

Review "device class" and "regulation number"

Understand "classification product code" implications

By Product Code: Deep-dive into specific categories

Review all devices within your product code

Identify classification precedents for similar technologies

Understand regulatory controls and requirements

Strategic Classification Intelligence:

Pathway Planning: Determine if 510(k), PMA, or De Novo applies

Competitive Landscape: See all devices in your category

Regulatory Requirements: Understand special controls and standards

Innovation Opportunities: Identify product codes with few devices

Access: Product Classification Database

De Novo Classification Database

Purpose: Research novel device pathways and emerging technologies

What's Inside:

All De Novo classification orders since 2012

Risk-based special controls for novel devices

Predicate-creating approvals for new device categories

Innovation pathway precedents

Advanced Search Techniques:

By Technology Type: Find similar innovations

Search broad technology terms (e.g., "artificial intelligence," "wireless")

Review special controls established for novel technologies

By Risk Profile: Understand FDA's risk-benefit analysis

Study rationale for Class II classification decisions

Learn about risk mitigation strategies that satisfied FDA

Innovation Intelligence:

Technology Trends: Identify emerging device categories

Special Controls: Understand requirements for novel technologies

Market Entry: Find successful precedents for breakthrough innovations

Predicate Creation: Become the predicate for future devices

Access: De Novo Database

Devices@FDA Quick Search

Purpose: Combined search across 510(k) and PMA databases

What's Inside:

Simplified interface for basic searches

Device name and approval date filtering

Quick competitor analysis capabilities

Best Use Cases:

Initial Market Scans: Quick overview of approval landscape

Competitor Monitoring: Regular checks on competitor activity

Broad Technology Searches: When you need general market intelligence

Limitations: Less detailed search options than individual databases

Access: Devices@FDA

Post-Market Intelligence Databases

MAUDE - Medical Device Reports

Purpose: Track adverse events, safety issues, and device performance

What's Inside:

Mandatory reports from manufacturers, importers, and device user facilities

Voluntary reports from healthcare professionals and patients

Death, injury, and malfunction reports

Trending safety signals and emerging issues

Critical Search Strategies:

By Product Code: Monitor your device category

Set up regular searches to track safety trends

Compare adverse event rates between competitors

Identify common failure modes and design issues

By Event Type: Focus on specific safety concerns

Search "death," "injury," or "malfunction" for severity analysis

Track recurring problems across multiple manufacturers

Identify user error patterns and training opportunities

Competitive Safety Intelligence:

Risk Benchmarking: Compare your safety profile to competitors

Design Insights: Learn from others' device failures

Regulatory Risks: Identify devices under FDA scrutiny

Market Opportunities: Find underperforming competitors

Red Flags to Watch:

Multiple reports of same failure mode

Increasing report frequency over time

Reports mentioning "recall" or "FDA investigation"

Class I recall recommendations in reports

Access: MAUDE Database

Medical Device Recalls Database

Purpose: Monitor recall activity and root cause analysis

What's Inside:

All medical device recalls since November 2002

Recall classifications (Class I, II, III)

Root cause analysis and corrective actions

Manufacturer recall strategies and effectiveness

Strategic Recall Intelligence:

By Product Code: Monitor category-wide recall patterns

Identify common recall reasons in your device category

Understand typical corrective actions and timelines

Benchmark recall response strategies

By Root Cause: Learn from others' failures

Software issues, manufacturing defects, labeling problems

Use insights for risk management and design controls

Prevent similar issues in your own devices

Access: Medical Device Recalls

Registration & Listing Database

Purpose: Research manufacturer information and market presence

What's Inside:

All establishments manufacturing medical devices

Device listings in commercial distribution

Manufacturer locations and capabilities

Annual registration updates

Competitive Intelligence Applications:

Supply Chain Analysis: Identify contract manufacturers

Market Mapping: Understand geographic distribution of manufacturers

Partnership Opportunities: Find potential manufacturing partners

Competitive Monitoring: Track new market entrants

Access: Registration & Listing Database

AccessGUDID - Unique Device Identification

Purpose: Device identification and supply chain intelligence

What's Inside:

Unique Device Identifiers (UDI) for all medical devices

Device specifications and identifiers

Manufacturing and distribution information

Global Medical Device Nomenclature (GMDN) data

Strategic UDI Intelligence:

Product Differentiation: Understand detailed device specifications

Supply Chain Mapping: Track device distribution patterns

Competitive Analysis: Compare technical specifications

Market Segmentation: Identify device variants and configurations

Access: AccessGUDID

Total Product Lifecycle (TPLC) Database

Purpose: Comprehensive device lifecycle view from pre-market to post-market

What's Inside:

Combined pre-market and post-market data

PMA and 510(k) approvals linked to adverse events and recalls

Full device lifecycle intelligence in one interface

Product line reports and trending analysis

Advanced Lifecycle Intelligence:

Holistic Risk Assessment: Connect approval data with safety performance

Long-term Performance: Track device performance over time

Competitive Benchmarking: Complete competitor lifecycle analysis

Investment Decisions: Understand full commercial success factors

Access: TPLC Database

522 Post-Market Surveillance Studies

Purpose: Track mandatory post-market study requirements

What's Inside:

Studies required under Section 522 of FD&C Act

Study protocols and progress reports

Manufacturer compliance with study commitments

Real-world evidence generation requirements

Post-Market Intelligence:

Regulatory Expectations: Understand FDA's post-market evidence requirements

Competitive Burden: Assess ongoing study commitments for competitors

Evidence Strategy: Learn from successful post-market study designs

Access: 522 Post-Market Studies

Reference & Compliance Databases

CFR Title 21 - Federal Regulations

Purpose: Searchable access to medical device regulations

What's Inside:

Regulatory Intelligence:

Compliance Requirements: Understand specific regulatory obligations

Historical Changes: Track regulatory evolution over time

Interpretation Guidance: Find official regulatory language

Access: eCFR Title 21

FDA Guidance Documents Database

Purpose: FDA's interpretation of regulations and policies

What's Inside:

Current guidance documents across all medical device topics

Draft and final guidance with implementation timelines

Withdrawn guidance and historical policy evolution

Search by product, topic, or FDA organization

Strategic Guidance Intelligence:

Regulatory Interpretation: Understand FDA's current thinking

Submission Strategy: Learn best practices from official guidance

Emerging Policies: Track draft guidance for future requirements

Historical Context: Understand policy evolution and precedent

Access: FDA Guidance Documents

FDA Recognized Consensus Standards

Purpose: Voluntary standards accepted by FDA for device approval

What's Inside:

FDA-recognized voluntary consensus standards

Standards organizations and development bodies

Search by standard number, product code, or keyword

Declaration of conformity acceptance criteria

Standards Intelligence:

Submission Shortcuts: Use recognized standards to streamline approvals

Competitive Standards: See which standards competitors reference

Emerging Requirements: Track newly recognized standards

International Harmonization: Understand global standards acceptance

Access: Recognized Consensus Standards

International Regulatory Databases

While FDA databases provide comprehensive US market intelligence, global medical device companies need broader regulatory visibility.

European Union - EUDAMED

Purpose: EU Medical Device Regulation (MDR) compliance and market intelligence

What's Inside:

CE-marked device registrations

Authorized representative information

Clinical investigation data

Post-market surveillance reports

Key Differences from FDA:

Focuses on conformity assessment rather than pre-market approval

Includes notified body certificates and decisions

Post-market clinical follow-up (PMCF) data

Unique Device Identification (UDI) database integration

Strategic Value: Essential for EU market entry and global competitive intelligence

Access: EUDAMED Portal

Health Canada Medical Device License Database

Purpose: Canadian market approval and device intelligence

What's Inside:

Medical Device Licenses (MDL) for Class II-IV devices

Device identification and specifications

License holder information and conditions

Regulatory pathway and classification decisions

Intelligence Applications:

North American Strategy - Compare US 510(k) vs Canadian MDL approaches

Competitive Timing - Track competitor market entry sequences

Regulatory Precedent - Understand Canadian-specific requirements

TGA Australian Database

Purpose: Therapeutic goods administration device registrations

What's Inside:

Australian Register of Therapeutic Goods (ARTG)

Device classifications and regulatory pathways

Sponsor information and conditions

Conformity assessment procedures

Strategic Applications: Pacific market intelligence and regulatory harmonization insights

Global Harmonization Considerations

Regulatory Intelligence Strategy:

Use FDA databases for detailed technical and safety intelligence

Leverage international databases for global market timing and competitive positioning

Cross-reference approval sequences to understand multinational regulatory strategies

Monitor international adverse event patterns for comprehensive risk assessment

Market Entry Sequencing: Many companies use FDA approval as global regulatory precedent, making US database intelligence valuable for worldwide strategy planning.

Advanced Search Strategies

Power User Techniques

Boolean Search Logic:

Use AND, OR, NOT operators for precise results

Combine multiple search fields for targeted intelligence

Use quotation marks for exact phrase matching

Date Range Optimization:

Recent Activity: Last 12 months for current market intelligence

Historical Trends: 3-5 year ranges for market evolution analysis

Regulatory Shifts: Compare pre/post guidance or regulation changes

Cross-Database Validation:

Start with Product Classification for device codes

Use 510(k) database for predicate research

Validate with MAUDE for safety intelligence

Confirm with TPLC for complete lifecycle view

Competitive Intelligence Workflows

New Competitor Analysis:

Search Registration & Listing for company information

Review 510(k)/PMA databases for approved devices

Check MAUDE for safety performance

Analyze TPLC for complete competitive profile

Market Entry Research:

Product Classification for regulatory pathway

510(k)/PMA/De Novo for precedent analysis

Standards database for compliance requirements

Guidance documents for submission strategy

Ongoing Market Monitoring:

Set up regular searches for competitor activity

Monitor adverse event trends in your product category

Track new guidance and standards affecting your market

Analyze approval patterns and timing trends

Common Mistakes to Avoid

Search Strategy Errors

Mistake: Using only exact device names

Solution: Start broad, then narrow with product codes and synonyms

Mistake: Ignoring date ranges

Solution: Recent data shows current FDA expectations; historical data provides precedent

Mistake: Single database searches

Solution: Cross-reference multiple databases for complete intelligence

Data Interpretation Pitfalls

Mistake: Assuming all 510(k) predicates are valid

Solution: Verify predicate device is still legally marketed and appropriate

Mistake: Over-interpreting MAUDE data

Solution: Consider reporting bias and denominator issues

Mistake: Ignoring recall patterns

Solution: Use recall intelligence for risk management and design improvements

Competitive Intelligence Missteps

Mistake: Focusing only on direct competitors

Solution: Monitor adjacent technologies and emerging players

Mistake: Ignoring post-market performance

Solution: Connect approval data with real-world safety performance

Next Steps: Turning Database Intelligence into Strategy

FDA databases provide the raw intelligence needed for smarter regulatory decisions, but the real value comes from systematic analysis and strategic application.

Immediate Actions:

Audit Your Current Approach - How are you currently using these databases?

Set Up Monitoring Systems - Create regular search schedules for competitive intelligence

Train Your Team - Ensure regulatory and business development teams know these advanced techniques

Integrate with Strategy - Connect database insights to regulatory pathway planning and competitive positioning

Advanced Applications:

Predicate Strategy Optimization - Find the strongest predicate chains for your 510(k)

Clinical Development Planning - Use PMA precedents to design efficient clinical trials

Risk Management - Leverage MAUDE intelligence for proactive safety planning

Market Timing - Understand FDA review patterns for optimal submission timing

FDA databases transform from overwhelming bureaucratic tools into strategic weapons when you know how to extract the right intelligence. Master these search techniques, and you'll make faster regulatory decisions, avoid costly mistakes, and gain significant competitive advantages.

Ready to dive deeper into regulatory strategy? Explore our guides on 510(k) predicate selection, PMA clinical development, and regulatory pathway optimization to turn database intelligence into approval success.

The Fastest Path to Market

No more guesswork. Move from research to a defendable FDA strategy, faster. Backed by FDA sources. Teams report 12 hours saved weekly.

FDA Product Code Finder, find your code in minutes.

510(k) Predicate Intelligence, see likely predicates with 510(k) links.

Risk and Recalls, scan MAUDE and recall patterns.

FDA Tests and Standards, map required tests from your code.

Regulatory Strategy Workspace, pull it into a defendable plan.

👉 Start free at complizen.ai

Frequently Asked Questions

How often are FDA databases updated?

Most FDA databases update daily or weekly. The 510(k) and PMA databases typically update within 24-48 hours of FDA decisions. MAUDE updates continuously as reports are submitted. Registration & Listing updates weekly, usually every Monday.

Can I set up automated alerts for FDA database changes?

Yes, several databases offer RSS feeds and email alerts. The 510(k) database allows email notifications for specific product codes. MAUDE offers RSS feeds for adverse event monitoring. For comprehensive automated monitoring across all databases, specialized platforms like Complizen provide unified alerting systems.

Are FDA database searches free?

All FDA database searches are completely free. These are public databases funded by taxpayers. However, accessing and analyzing data efficiently often requires significant time investment or specialized tools for systematic competitive intelligence.

How far back do FDA databases go?

Most databases contain decades of historical data. The 510(k) database includes submissions since 1976. PMA data goes back to 1976. MAUDE contains reports since 1991, with more detailed data from 2000 forward. Device recalls are available from November 2002 onward.

Can I download bulk data from FDA databases?

Yes, most databases offer bulk download options. AccessGUDID provides complete database downloads. The 510(k) and PMA databases allow filtered exports. However, bulk data often requires technical processing to extract actionable intelligence.

What's the difference between searching individual databases vs. combined platforms?

Individual FDA databases offer detailed search options but require manual correlation across multiple sources. Combined platforms like Devices@FDA provide convenient searching but limited functionality. Comprehensive platforms unify all databases with advanced analytics and cross-referencing capabilities.

How do I know if my predicate device search is complete?

Effective predicate searches require multiple validation steps: Search by device name AND product code, verify the predicate is still legally marketed, check for recalls or safety issues in MAUDE, and confirm substantial equivalence arguments in the 510(k) summary.

Are international regulatory databases as comprehensive as FDA databases?

No, most international databases are less detailed than FDA databases. EUDAMED focuses on registration rather than detailed technical submissions. Health Canada's database provides basic device information but limited competitive intelligence. FDA databases remain the gold standard for regulatory intelligence depth.