FDA Complete Guide: Everything Medical Device Companies Need to Know 2025

- Beng Ee Lim

- Jul 28, 2025

- 8 min read

Updated: Sep 7, 2025

The FDA’s Center for Devices and Radiological Health (CDRH) regulates medical devices in the United States. Devices reach the market via 510(k) clearance, De Novo classification, or PMA approval, depending on risk and predicate status. Under MDUFA V, FDA’s review goals include 510(k) decisions within 90 FDA days, De Novo within 150 FDA days, and PMA average total time to decision of 285–290 days. Companies that understand FDA's decision-making process, build early relationships with reviewers, and leverage competitive intelligence from FDA databases cut approval times and avoid costly submission mistakes.

This guide reveals how smart companies turn FDA requirements from compliance burdens into competitive weapons.

Why FDA Mastery = Business Success

FDA approved more than 100 novel devices in 2018, a fourfold increase over 2009, yet most companies still treat regulatory strategy as an afterthought. Here's the brutal reality:

The $10 Million Mistake: Poor FDA strategy costs the average medtech startup $2-10 million in preventable delays, failed submissions, and redesign costs.

The Speed Advantage: Companies using expedited FDA pathways like Breakthrough Device Designation get products to market 1-2 years faster than competitors following standard routes.

The Intelligence Gap: Majority of companies manually search FDA databases when intelligent platforms could reveal competitive insights in minutes.

What This Costs You

Wrong Pathway Selection: Choosing PMA over 510(k) unnecessarily = $5-15 million extra in clinical trials

Poor Predicate Selection: Weak 510(k) predicate = 6-12 month review delays

Quality System Failures: FDA 483 observations = $500K-$2M in remediation costs

Late FDA Engagement: No pre-submission meetings = 40% higher chance of additional information requests

Smart companies flip this equation: They use FDA requirements to accelerate development, block competitors, and build market advantages.

The Power Structure: Who Really Controls Your Approval

Understanding FDA's decision-making hierarchy determines whether you get fast-track treatment or regulatory purgatory.

The CDRH Command Structure

Center Director: Sets policy priorities - currently focused on AI/digital health, cybersecurity, and real-world evidence

Associate Center Directors: Control budget allocation and strategic initiatives

Division Directors: Make actual approval decisions for your device type

The 8 Device Kingdoms

CDRH's Office of Health Technologies divides into 8 specialized divisions that operate like separate fiefdoms:

OHT 1 Ophthalmic, Anesthesia, Resp/ENT, Dental

OHT 2 Cardiovascular

OHT 3 Reproductive, Gastro-Renal, Urological, General Hospital Device and Human Factors

OHT 4 Surgical & Infection Control

OHT 5 Neurological & Physical-Medicine

OHT 6 Orthopedic

OHT 7 In Vitro Diagnostics

OHT 8 Radiological Health

Strategic Intelligence: Each division has different personalities, priorities, and approval patterns. Knowing your division's quirks = faster approvals.

The Real Decision Makers

Lead Reviewers: The individual scientist who controls your submission's fate

Branch Chiefs: Escalation point for complex decisions

Division Directors: Final authority on novel or controversial devices

Relationship Reality: Companies with established relationships get more constructive feedback and faster resolution of issues. This isn't about gaming the system—it's about building trust through competence and transparency.

The Three Pathways That Determine Your Fate

Every device follows one of three routes to market. Choose wrong, and you'll waste years and millions.

510(k): The Volume Game

The Numbers: Annual 510(k) clearances range from 2,804 to 5,762 (median 3,404)

Success Rate: ~95% get substantial equivalence

Hidden Cost: $50K-$500K total cost including testing and consulting

Timeline Reality: 90-day FDA goal, 4-8 months actual average

When It Works: Clear predicate exists, technology is incremental improvement

When It Fails: Novel technology, no appropriate predicate, safety questions

Strategic Advantage: Use FDA's 510(k) database to find "predicate chains" - sequences of devices that establish regulatory precedent for increasingly sophisticated technology.

PMA: The Clinical Gauntlet

The Numbers: Annual PMA approvals range from 8 to 56 (median 32)

Success Rate: ~78-85 % approval rate after cycles.

Real Cost: $5-50+ million including clinical trials

Timeline Reality: 18+ months from submission to approval

When It's Required: Class III devices, life-sustaining/supporting devices, novel high-risk technology

Strategic Edge: Companies conducting adaptive clinical trials and leveraging real-world evidence get FDA approval 20-30% faster

De Novo: The Innovation Pathway

The Opportunity: Become the predicate device for entire new categories

Timeline: 150 days for FDA decision

Strategic Value: De Novo devices create new markets and establish competitive moats

When to Use: No predicate exists, automatic Class III designation inappropriate, breakthrough technology

The Hidden Costs of FDA Compliance

Most companies budget for user fees and miss the real costs:

User Fees (The Visible Costs)

FY 2025 Rates:

510(k): $24,335 (standard), $6,084 (small business)

PMA: $540,783 (standard), $135,196 (small business)

De Novo: $162,235 (standard), $40,559 (small business)

User-fee revenue has surged 8-fold since 2003, covering nearly one-third of FY 2019 review costs (and 43 % in 2020).

The Real Costs (The Invisible Killers)

Quality System Implementation: $200K-$2M for robust QSR compliance

Clinical Trials: $1-20M depending on study design and endpoints

Regulatory Consulting: $150K-$1M for complex submissions

Opportunity Cost: 6-18 months delayed market entry = $5-50M in lost revenue

The 2026 Bomb: Quality Management System Regulation (QMSR) takes effect February 2, 2026, requiring transition from current QSR to ISO 13485:2016 alignment. Companies starting transition now avoid last-minute compliance chaos.

2025 Game Changers: What's Different Now

The regulatory landscape shifted dramatically in 2025. Companies adapting fastest gain massive advantages.

AI Revolution and Regulatory Reality

The New Rules: FDA's AI draft guidance was first released in 2025, requiring clear documentation of algorithmic decision-making processes and continuous monitoring mechanisms.

Strategic Opportunity: AI-enabled devices get expedited review under breakthrough device designation, but only with robust validation data.

The Compliance Trap: Most AI companies underestimate FDA's software validation requirements. Build validation frameworks early or face 12+ month delays.

Cybersecurity: From Afterthought to Approval Blocker

New Reality: Medical device cybersecurity failures cost healthcare systems billions. FDA now requires:

Threat modeling throughout device lifecycle

Software Bill of Materials (SBOM)

Vulnerability management and incident response plans

Business Impact: Devices without cybersecurity documentation face automatic additional information requests, pushing decisions months past the 112-day target.

Real-World Evidence: The Data Advantage

FDA Priority: FDA is doubling down on NESTcc’s collaborative community—now tapping 220 M+ patient records—to weave high-quality real-world data into device submissions.

Strategic Value: Companies generating high-quality real-world data get faster approvals for label expansions and new indications.

The Competitive Intelligence Weapon

Smart companies don't just comply with FDA—they use FDA data to dominate competitors.

Database Mining for Market Domination

510(k) Intelligence: Track competitor approval patterns, identify market gaps, benchmark claims

PMA Analysis: Reverse-engineer successful clinical study designs, understand FDA expectations

MAUDE Monitoring: Identify competitor safety issues, benchmark your performance, spot market opportunities

Early Warning Systems

FDA Guidance Pipeline: Monitor draft guidance for advance warning of requirement changes

Advisory Panel Tracking: Follow device advisory committee meetings for regulatory trend signals

Enforcement Intelligence: Track FDA warning letters and 483 observations to avoid compliance pitfalls

Strategic Mistakes That Kill Companies

Learn from others' failures to avoid repeating expensive mistakes.

The $15 Million Predicate Mistake

Case Study: Startup selected weak predicate device for 510(k) submission. FDA issued Not Substantially Equivalent letter. Company had to conduct $15M clinical trial for PMA pathway instead.

Lesson: Invest $50K in predicate research to avoid $15M clinical trial.

The Quality System Death Spiral

Pattern: Company receives FDA 483 observations during pre-approval inspection. Approval delayed 12+ months while addressing quality system deficiencies.

Prevention: Implement robust quality systems early. FDA inspection readiness = faster approvals.

The Late Engagement Penalty

Reality: Companies waiting until submission to engage FDA face 40% higher rates of additional information requests

Solution: Pre-submission meetings save months and improve approval odds.

Working the System (Legally and Ethically)

Understanding FDA's human dynamics accelerates your path to approval.

The Relationship Factor

FDA Reality: Reviewers prefer working with competent, responsive companies

Strategic Approach: Build reputation through thorough submissions, prompt responses, and collaborative problem-solving

Long-term Value: Companies with good FDA relationships get benefit of doubt on borderline decisions

Communication Optimization

What Works: Clear questions, organized data, specific asks, proposed solutions

What Fails: Vague requests, incomplete information, adversarial tone, last-minute surprises

Meeting Strategy

Pre-submission Meetings: Essential for complex devices, novel technology, or unclear regulatory pathways

Advisory Panel Prep: For PMA devices, panel preparation determines approval success

Submission Issue Request (SIR): Use for general feedback on development programs

Decision Frameworks for Smart Companies

Turn this intelligence into action with clear decision criteria.

Pathway Selection Matrix

Choose 510(k) when:

Clear, strong predicate exists

Technology is incremental improvement

Safety profile similar to existing devices

Choose PMA when:

No appropriate predicate

Novel mechanism of action

High-risk life-sustaining device

Choose De Novo when:

Novel technology with moderate risk

Opportunity to create new device category

No predicate exists but PMA seems excessive

Timing Strategy

Early Stage: Focus on classification and pathway strategy

Development Phase: Engage FDA through pre-submission meetings

Pre-submission: Conduct competitive intelligence and predicate analysis

Post-submission: Maintain responsive communication and relationship building

Your Next Steps: Turn Intelligence into Advantage

Understanding FDA is worthless without strategic application. Here's how to convert this knowledge into competitive advantage:

Immediate Actions (This Week):

Classify your device and understand your regulatory pathway

Research competitors using FDA databases for intelligence gathering

Identify your FDA division and understand their specific priorities

Schedule pre-submission meeting if developing novel technology

Strategic Initiatives (Next 90 Days):

Build quality systems aligned with 2026 QMSR requirements

Develop FDA relationship strategy through industry conferences and meetings

Create competitive monitoring system for ongoing market intelligence

Plan clinical development if PMA pathway likely

Long-term Competitive Positioning:

Regulatory expertise as core competency, not outsourced function

FDA database intelligence integrated into business development strategy

Early engagement culture with regulatory authorities globally

Quality systems excellence preventing compliance surprises

The companies dominating medtech aren't just building better devices—they're building better regulatory strategies. In a heavily regulated industry, regulatory intelligence is competitive intelligence.

Ready to turn FDA requirements into competitive weapons? Master the specific pathways with our detailed guides on 510(k) strategy, PMA development, and regulatory database intelligence.

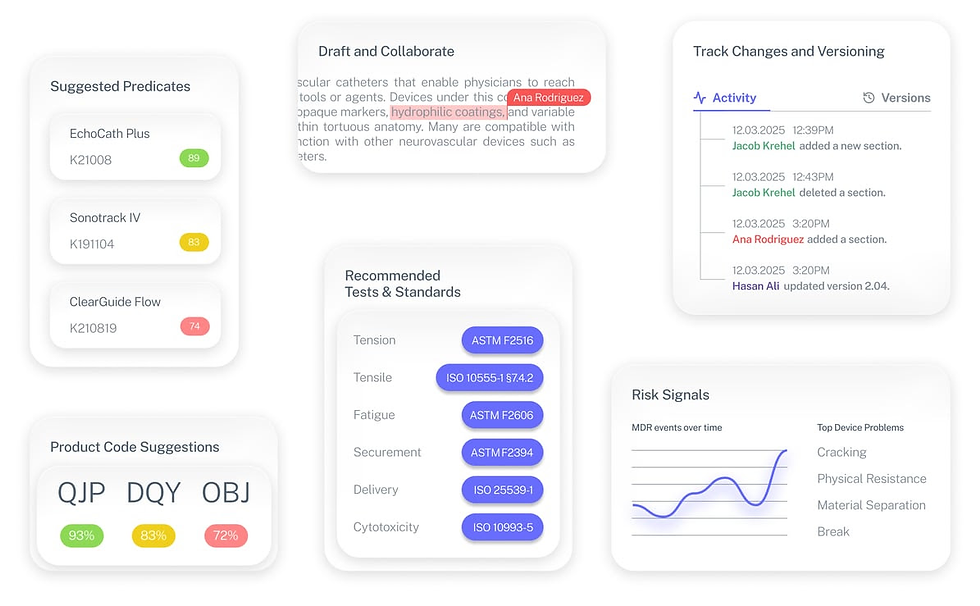

The Fastest Path to Market

No more guesswork. Move from research to a defendable FDA strategy, faster. Backed by FDA sources. Teams report 12 hours saved weekly.

FDA Product Code Finder, find your code in minutes.

510(k) Predicate Intelligence, see likely predicates with 510(k) links.

Risk and Recalls, scan MAUDE and recall patterns.

FDA Tests and Standards, map required tests from your code.

Regulatory Strategy Workspace, pull it into a defendable plan.

👉 Start free at complizen.ai

Frequently Asked Questions

What's the single biggest FDA mistake companies make?

Waiting too long to engage FDA. Companies with early FDA interaction get approvals 30-40% faster than those waiting until submission. Pre-submission meetings prevent costly mistakes and build relationships.

How much should I budget for FDA approval?

510(k) total costs: $100K-$750K including user fees, testing, consulting, and regulatory preparation. PMA total costs: $5M-$50M+ including clinical trials and multi-year development. Budget 2-3x initial estimates for contingencies.

Can small companies compete with big pharma at FDA?

Yes, with smart strategy. Small companies often get faster FDA attention because they're more responsive and focused. FDA's expedited programs like Breakthrough Device Designation specifically help innovative small companies.

How do I know if my device needs clinical trials?

Most 510(k) devices don't require clinical data - substantial equivalence can be demonstrated through bench testing. All Class III PMA devices require clinical trials. Some Class II devices need clinical data when technological differences raise safety/effectiveness questions.

What happens if FDA says no?

FDA rarely outright rejects devices. They typically request additional information or suggest alternative pathways. 95% of 510(k) submissions eventually receive clearance after addressing FDA concerns.

How important are FDA relationships really?

Critical for complex submissions. While FDA maintains objective standards, companies with established relationships get more constructive feedback, faster responses to questions, and collaborative problem-solving approaches.

Should I hire FDA consultants?

For complex devices, absolutely. Former FDA reviewers understand agency thinking and can accelerate approvals. Budget $150K-$500K for expert regulatory consulting on novel or high-risk devices.

What's changing in 2025 that affects my strategy?

Three major shifts: AI/software validation requirements tightening, cybersecurity becoming approval factor, and real-world evidence increasingly accepted for regulatory decisions. Companies adapting early gain competitive advantages.